Sep ira contribution calculator

SEP-IRA Plan Maximum Contribution Calculator. How do I calculate my SEP contribution.

Ira Retirement Calculator Forbes Advisor

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

. The SEP IRA calculator will use this information to calculate how much youll be required to contribute to your employee accounts based on your own contribution rate. SEP IRA Contribution Limits The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000. How to Calculate Self-Employment Tax.

For comparison purposes Roth. How to Calculate Cost of Goods. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan.

Ad Discover The Benefits Of A Traditional IRA. Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. Unlike other plans employees cant defer their salary to make contributions to a SEP-IRA.

Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

Supplementing your 401k or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones. SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing. For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for.

Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned income in the case of a. All SEP-IRA contributions are considered to. They may be able to make traditional IRA contributions to the.

How to Calculate Amortization Expense. Is SEP contribution 20 or 25. An employer may establish a SEP IRA for an employee who is entitled to a.

One of the nicest features of the SEP plan is the large amount you can put away for retirement. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged. You can contribute up to 25 of an employees total compensation or a maximum of 58000 in tax.

A Simplified Employee Pension SEP IRA is a retirement plan that allows for higher tax-deductible contributions tax-deferred growth hassle-free account maintenance and a. How much can I contribute to my SEP IRA. A One-Stop Option That Fits Your Retirement Timeline.

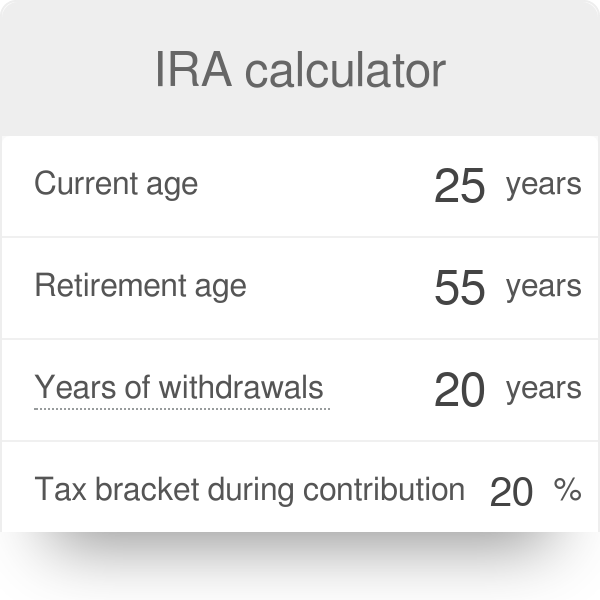

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Reviews Trusted by Over 45000000. Self-employment tax less your SEP IRA contribution.

SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. Self-Employed As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

Learn About 2021 Contribution Limits Today. Compare 2022s Best Gold Investment from Top Providers. SEP-IRA Contribution Limits.

Individual 401 k Contribution Comparison. If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan. S corporation C corporation or an LLC taxed as a corporation.

Ad Gain Clarity on How Much You Could Withdraw From Your Portfolio to Meet Your Income Needs. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Solo 401k Contribution Calculator Solo 401k

Ira Calculator See What You Ll Have Saved Dqydj

Ira Calculator

Sep Ira Contribution Calculator For Self Employed Persons

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Tax Calculator Internal Revenue Code Simplified

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

12 Reasons To Contribute To A Roth Ira By April 18

Sep Ira Plan Br Maximum Contribution Calculator

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

What You Need To Know About Simplified Employee Pensions Seps

Sep Ira Calculator Sepira Com

Free Simple Ira Calculator Contribution Limits

How To Calculate Sep Ira Contributions For An S Corporation Youtube